UK Government Considers Pension Tax Break Reforms to Boost Domestic Investment

The UK government is contemplating the potential withdrawal of pension tax breaks from asset managers who do not invest sufficiently within the country. This warning has been issued by Louis Taylor, CEO of the British Business Bank, highlighting the significant implications for the asset management industry as the government aims to drive key growth initiatives.

Call for Domestic Investment in Pension Funds

While Taylor clarified that he does not endorse this particular approach, he stressed that the government could enhance funding for growth-oriented projects without imposing full mandates or burdening taxpayers. The industry is advocating for tax incentives reminiscent of the system in Australia, which would promote increased investment.

Dependence on Private Sector Growth

With Prime Minister Keir Starmer depending on the private sector to achieve the growth promised by his Labour administration, funds that invest minimally in the UK are now under investigation. These funds benefit from significant tax relief on worker pension contributions, which results in an increase in assets under management.

Currently, the government has not set minimum investment allocations for UK assets, but Pensions Minister Emma Reynolds recently indicated that more stringent measures could still be on the table. "We’re not discussing it at the moment, but we will see where the situation leads,” Reynolds told the Financial Times, referring to the possibility of mandatory investment.

Potential Tax Legislation Changes

In a prior interview, Taylor suggested that instead of providing additional tax incentives, the government might consider withdrawing some existing benefits from funds that fail to meet investment expectations. “It is within the treasury’s rights to state that unless your scheme has invested a certain percentage in the UK, we will revoke the tax benefits currently provided,” he stated. “Such actions could positively impact the Treasury in a fiscal sense—any recouped funds would be a net benefit."

Pension contributions, which enjoy a tax relief of approximately £50 billion annually, are a significant aspect of public finances during times of economic difficulty. For basic-rate taxpayers, this relief amounts to 20%, while top-rate taxpayers receive 45%. A potential charge could lead to higher costs for pension funds that underinvest in the UK, even if they still choose to allocate some resources overseas.

Economic Challenges and Growth Commitments

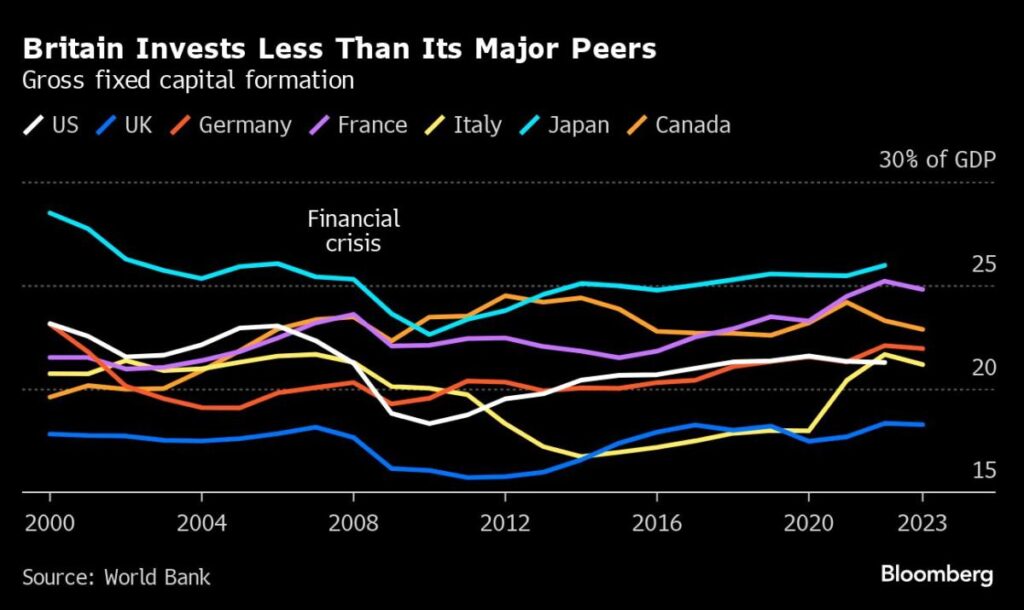

Starmer has ambitious goals, promising an annual growth rate of 2.5% alongside efforts to lift living standards in a UK economy that has struggled with productivity since the global financial crisis of 2008-09. Recent figures from the Office for National Statistics reveal a mere 1% growth for the year leading up to September, a situation often attributed to a long-standing lack of investment in infrastructure and new ventures.

Ministers hope to see pension funds allocate at least 5% of their assets to domestic investments, believing that a new disclosure regime will foster voluntary compliance. Taylor noted that the possibility of retracting tax breaks could amplify investments in crucial areas like infrastructure and venture capital, while also raising concerns about the UK’s image among international investors who value market freedom.

Navigating the Path Forward

Taylor acknowledged the complexities the government will face. “This issue presents significant challenges,” he said. “There are no simple solutions, and any changes must be made gradually. However, the government does have the capacity to positively influence economic growth. Both venture capital and infrastructure investments demand time and patience, and pension funds are ideally suited for such long-term commitments.”

The British Business Bank, an independent development bank aimed at assisting small and medium-sized enterprises, currently has £7.9 billion available for co-investment with private sector partners and manages several state loan guarantees.

Future Directions for Pension Funds

Chancellor of the Exchequer Rachel Reeves is taking a cautious approach, recently promising new legislation to consolidate the fragmented pension fund sector into fewer, more substantial participants capable of investing in major projects and scaling startups. This move aims to unlock £80 billion for domestic investment. In a Bloomberg TV interview, Reeves reassured that there are currently no plans to mandate pension funds.

Going forward, Taylor highlighted the UK’s pension funds’ underperformance compared to those in the US, Canada, and Australia, which tend to invest significantly more in private equity and venture capital, yielding better returns for their members. “The UK possesses the second-largest pool of pension funds globally, yet they are not adequately invested in our economy’s growth,” he remarked. “Investors should favor the UK, which is a robust ecosystem for innovation.” According to research by New Financial, UK pension funds now allocate only 4.4% to domestic stocks, a sharp decline from the 50% seen at the start of the millennium.

Differing Views on Legislative Measures

Interestingly, not all investors are against mandating investments, as some trustees face rigorous scrutiny regarding fees, which can push them toward safer asset classes. “For some, a mandate might simplify the decision-making process around venture capital investments, while others may view it as an infringement on their investment choices,” Taylor observed.

The journey ahead holds both challenges and opportunities as the UK government navigates the landscape of economic recovery and growth through domestic investment in pension funds.