The Shift Towards Financialisation in India

Financialisation refers to the ongoing transition from investing in traditional physical assets, like real estate and gold, to a focus on financial assets. This shift is significantly influencing the financial landscape in India.

According to the Reserve Bank of India (RBI), Indians collectively hold approximately ₹319 lakh crores (around $3.7 trillion as of December 24). To put this into perspective, this amount surpasses India’s Gross Domestic Product (GDP) of about $3.3 trillion. It’s worth noting that this figure does not include direct investments in equity markets.

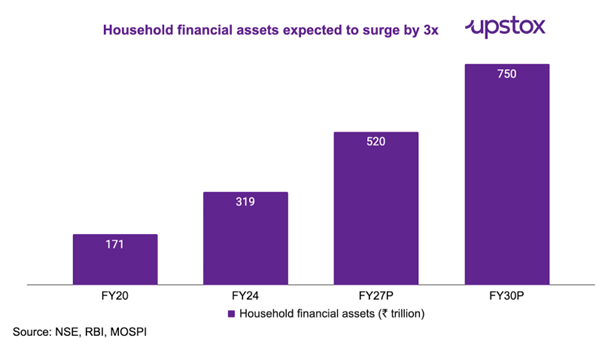

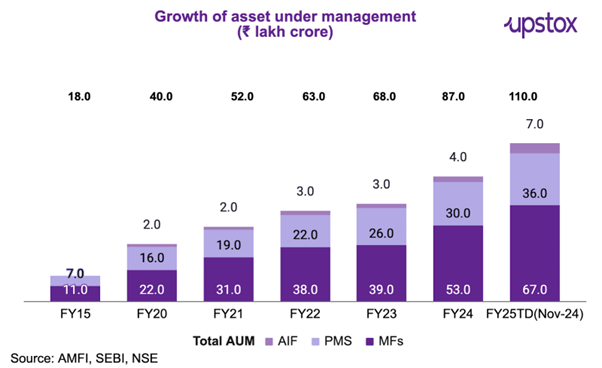

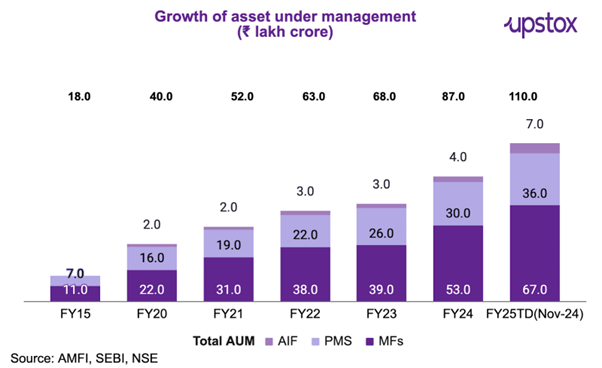

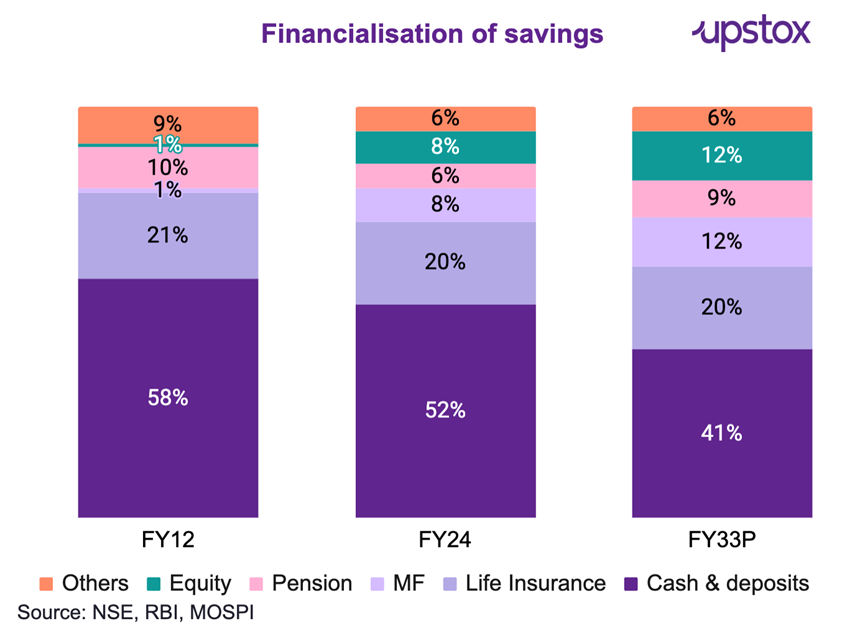

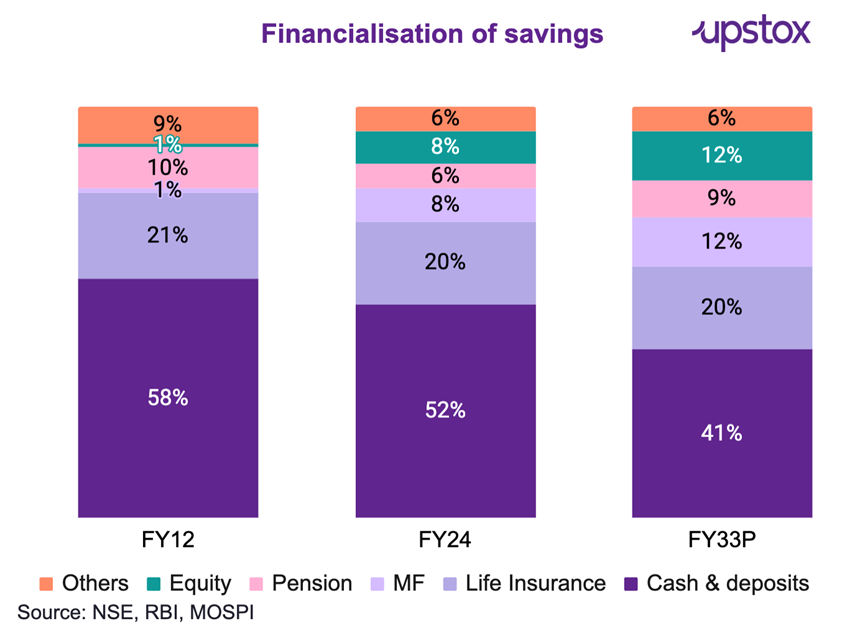

Currently, about 44% of these financial assets are held in bank deposits, which reflects a decrease from roughly 47% in June 2021. The process of financialisation in India has not happened overnight; it has steadily progressed, gathering remarkable momentum since the onset of the COVID-19 pandemic. As illustrated in the chart below, financial assets have nearly doubled during this period.

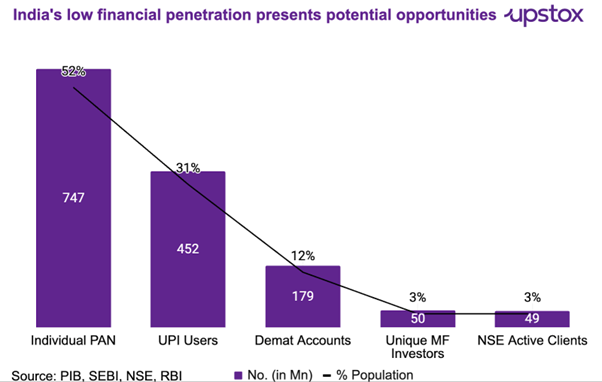

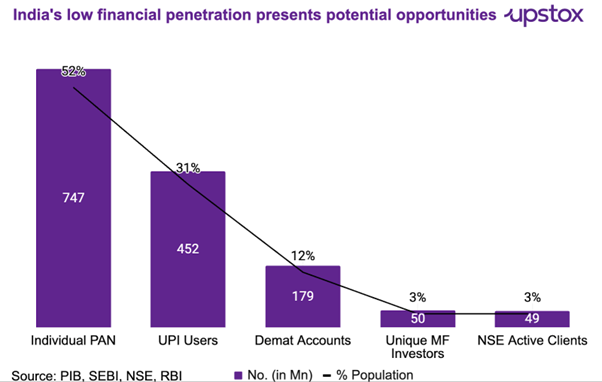

The remarkable increase in financial assets can be credited to several factors, including the ease of opening bank accounts, the widespread adoption of UPI technology, and advancements in digital platforms that make investing simpler. As a result, participation in asset classes such as mutual funds has nearly doubled since June 2021.

Rising Aspirations: The Premiumisation of Indian Households

A significant long-term driver for financialisation is the premiumisation trend amongst Indian households. Projections indicate that the number of elite and affluent households will double, while aspirational and emerging middle-class segments are expected to grow rapidly, outpacing low-income households. As household wealth increases, there is a corresponding demand to invest these resources in productive assets.

| Income Bracket | 2010 (% of HH) | 2010 (No. of HH in Cr.) | 2019 (% of HH) | 2019 (No. of HH in Cr.) | 2030F (% of HH) | 2030F (No. of HH in Cr.) | Growth (2019-30F) |

|---|---|---|---|---|---|---|---|

| Low income (<1.5L) | 33.0 | 7.9 | 22.0 | 6.4 | 11.0 | 4.0 | 0.6x |

| Middle Income (1.5L-5L) | 46.0 | 10.8 | 45.0 | 13.9 | 40.0 | 14.2 | 1.1x |

| Aspirers (5L-10L) | 15.0 | 3.5 | 21.0 | 5.0 | 26.0 | 9.3 | 1.6x |

| Affluent (10L-20L) | 5.0 | 1.3 | 9.0 | 2.6 | 16.0 | 5.6 | 2.1x |

| Elite (>20L) | 1.0 | 0.3 | 3.0 | 1.0 | 7.0 | 2.3 | 2.3x |

| Total households | 100.0 | 23.8 | 100% | 28.9 | 100% | 35.4 | – |

Source: Crisil; HH – Households

India’s Strong Saving Culture

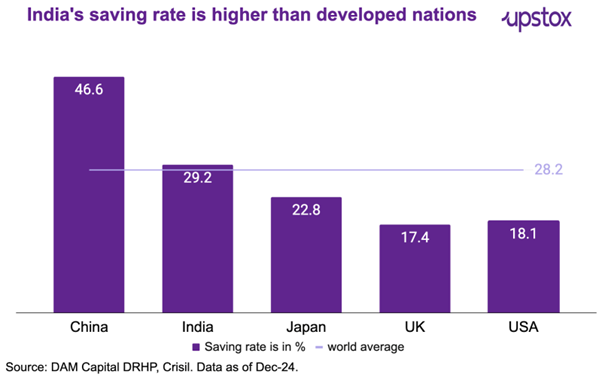

India has a rich history of strong conventional savings practices. From an early age, we are encouraged to save money, leading to a gross saving rate that surpasses the global average. As financial literacy increases and more Indians participate in the economy, the trend towards financialisation and higher-yielding asset classes is expected to rise.

The Transition to More Productive Assets

What gives us confidence in the potential for savings to channel into more productive financial assets? The assets under management in mutual funds, Portfolio Management Services (PMS), and Alternative Investment Funds (AIF) have seen nearly a threefold increase since the pandemic, indicating a shift toward structured financial products.

A Promising Future for Financialisation

Despite the recent upsurge in financialisation, there remains vast potential. Presently, only about 3% of Indians actively engage in trading and investing in equities and mutual funds. However, with rising digital penetration and improved financial inclusion through initiatives like UPI, PAN cards, and demat accounts, the investing population in India is poised for exponential growth.

According to the National Stock Exchange (NSE), equity’s share in total household financial assets is projected to increase from 8% to 12%. Interestingly, among the various financial assets held by households, the proportion of equity, mutual funds, and insurance is expected to rise, while cash and deposits are likely to decline.

Opportunities for Investors

Investors have the opportunity to directly engage in this growth by participating in benchmark indices. Those interested in capitalising on financialisation trends may consider investing in the Nifty Capital Market Index, which focuses on businesses aligned with this financial transition.

As of December 31, 2024, here are the top constituents of the Nifty Capital Market Index:

| Company | Weightage % |

|---|---|

| BSE | 19.7 |

| HDFC Asset Management Company | 13.3 |

| Multi Commodity Exchange of India | 9.9 |

| Central Depository Services (India) | 9.8 |

| 360 ONE WAM | 7.6 |

| Computer Age Management Services | 7.6 |

| Kfin Technologies | 5.5 |

| Angel One | 5.3 |

| Motilal Oswal Financial Services | 4.4 |

| Indian Energy Exchange | 4.3 |

Source: NSE

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Investors are advised to consult with professionals before making any investment decisions.