Banco Santander Lowers Asset Sale Projections Amid Intensifying Competition

(Bloomberg) — Banco Santander SA, a significant player in Europe’s banking sector known for its aggressive asset and risk sales, is adjusting its targets for the upcoming year. This change comes as the competition among financial institutions to attract private credit investors, including industry giants like Apollo Global Management Inc. and Blackstone Inc., continues to escalate.

Anticipated Asset Removal and Market Dynamics

Due to robust demand for bank assets, Spain’s largest bank is poised to divest €60 billion ($63 billion) in risk-weighted assets from its balance sheet this year, according to Sergio Gamez, head of the Global Asset Desk (GAD) responsible for this initiative. However, he projects this figure will decrease to €40 billion by 2025, citing an interview at the bank’s Madrid headquarters.

A Sustainable Strategy Moving Forward

Gamez elaborated on the anticipated reduction, referring to comments made by Chief Financial Officer Jose Garcia Cantera during a recent analyst meeting, where Cantera indicated that this lower projection would be more sustainable in the long term.

Centralized Asset Mobilization Efforts

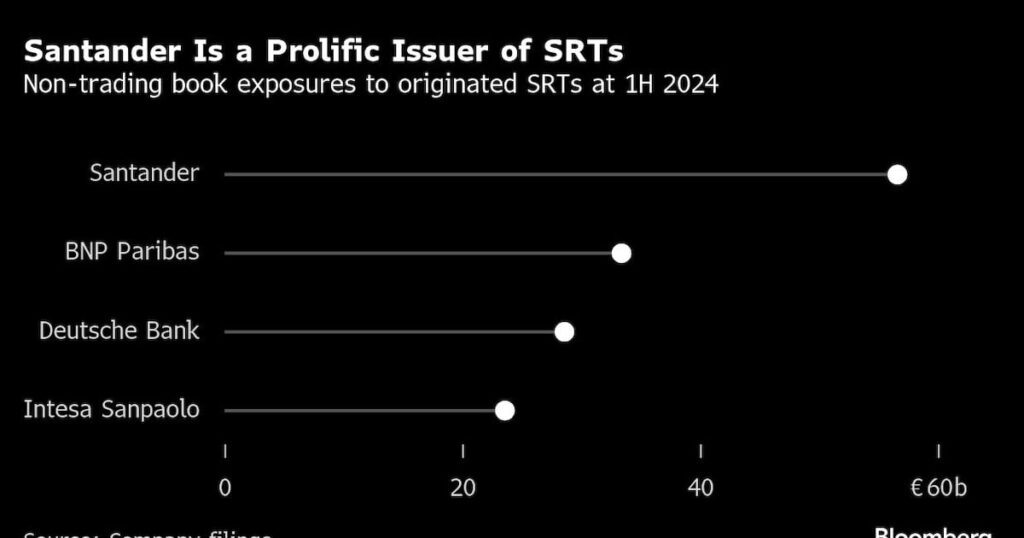

The GAD unit is pivotal in Santander’s asset mobilization strategy, which has established the bank as a prolific seller of assets and credit risks. This strategy employs significant risk transfers (SRTs), allowing the bank to release capital tied to loans by compensating investors to assume part of the credit risk.

A Growing Competitive Landscape

However, Santander faces increasing competition from other banks aiming to offload assets and risks. The popularity of SRTs is surging, which, according to S&P Global Ratings, may lead to less favorable pricing for banks issuing these securities.

Centralized Deal Execution and Team Expansion

While Santander has historically used asset sales and SRTs to optimize its balance sheet, Gamez highlights that the centralized approach facilitated by the GAD has sharpened the program’s focus, allowing for securitizations across various jurisdictions and loan types. In mid-2023, Gamez was tasked with accelerating asset rotation and has since assembled a team of around 50 professionals from various global locations.

Capital Relief Trades and Profitability Prospects

These capital relief trades are expected to bolster Santander’s pretax profit by approximately €800 million this year, as stated by Cantera during the analyst meeting, with insights shared by Barclays Plc analysts.

Addressing Capital Constraints

Capital relief trades play a crucial role for Santander, which has historically maintained lower capital levels compared to peers. Analysts suggest that this disparity limits the bank’s capacity to make strategic moves such as acquisitions, though there are expectations that this gap will narrow moving forward.

Analysts from Morgan Stanley, including Alvaro Serrano and Giulia Aurora Miotto, noted last month that Santander’s ability to enhance its capital ratios was previously a significant concern for investors. However, they acknowledged a more positive outlook for the lender, largely attributed to its engagement with SRTs.

Current Asset Offloading Initiatives

As part of its asset mobilization strategy, Santander is reportedly looking to sell €150 million ($158 million) of mortgages to KKR & Co. Additionally, sources indicate that a sale of €900 million in similar loans to Morgan Stanley is nearing completion, although representatives from Santander and KKR chose not to comment on these details.

Strategic Partnerships with Credit Investment Firms

In an effort to enhance its offerings, Santander is collaborating with major credit investment firms that assume some of the loans the bank originates, benefiting from less stringent regulatory oversight since these firms do not accept deposits.

Investor Demand and Future Projections

Recently, Blackstone Inc. and Apollo Global Management Inc. each invested in Santander’s infrastructure loans valued at $1 billion and $370 million, respectively. The crux of the matter lies in the sustainability of the investor demand supporting Santander’s asset mobilization program.

Regulatory Changes and Potential Challenges Ahead

Many banks are increasing their use of SRTs, and this growing supply could compel them to offer more attractive returns to investors. The European Central Bank’s plans to expedite approval processes may further stimulate issuance, presenting new dynamics in the market.

From 2024 onward, new capital rules known as the Basel “endgame” could require banks to sell more considerable risk components to achieve necessary capital relief, according to a November report by S&P Global Ratings. The firm also noted that SRT pricing may not remain as advantageous for issuers as it has been in the recent past.

Exploring Innovative Financing Options

In light of these anticipated changes, Santander is exploring innovative strategies to maintain elevated levels of balance sheet rotation. Gamez is investigating the potential of so-called forward flow agreements in 2025, which would involve collaborative arrangements with private credit firms to finance future lending.

Increased Regulatory Scrutiny on the Horizon

Additionally, regulatory scrutiny is intensifying, with the International Monetary Fund highlighting potential “negative feedback loops” stemming from SRTs. Regulatory bodies are closely examining the relationships between banks and non-bank investors regarding their loans and associated risks, particularly when financing comes from other banks.

Claudia Buch, head of banking supervision at the ECB, recently emphasized the importance of ensuring that securitization practices do not adversely affect the banking sector.

–Contributions from Claudia Cohen, Bruce Douglas, and Helene Durand.

©2024 Bloomberg L.P.