Insights from PwC’s Recent Asset and Wealth Management Survey

In a newly released asset and wealth management survey by PwC, notable disparities have emerged between asset managers and the institutional investors they service, particularly concerning digital assets and tokenization.

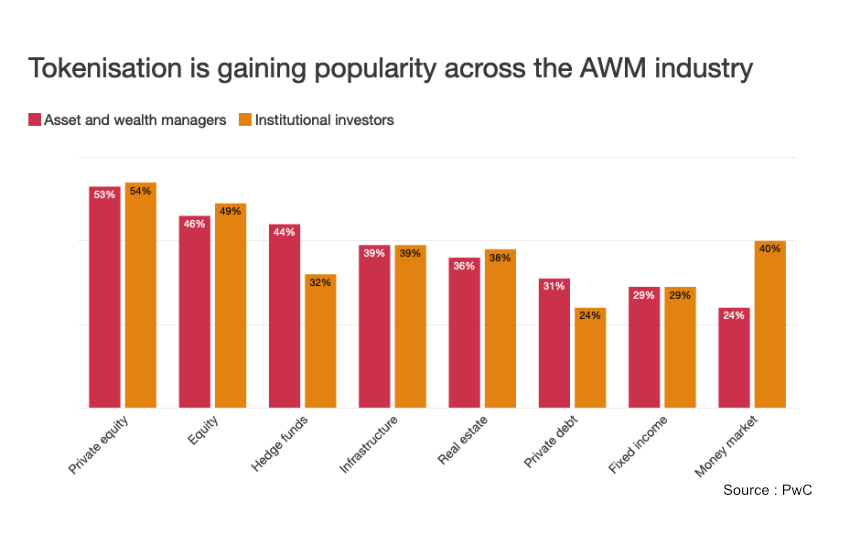

Interest in Tokenization Across Sectors

One significant finding from PwC’s survey focused on institutional investors’ interest in various sectors related to tokenization. Surprisingly, despite substantial media coverage, money market funds showed the largest gap. While 40% of institutional investors either currently invest in or plan to invest in tokenized money market funds, only 24% of asset managers provide or intend to offer these opportunities.

Furthermore, asset managers may have overestimated investor enthusiasm for the tokenization of hedge funds and private debt. According to the data, while 31% of asset managers view private debt as an appealing sector for tokenization, only 24% of investors share this interest. Interestingly, both asset managers and investors agree that private equity remains the most desirable sector for tokenization.

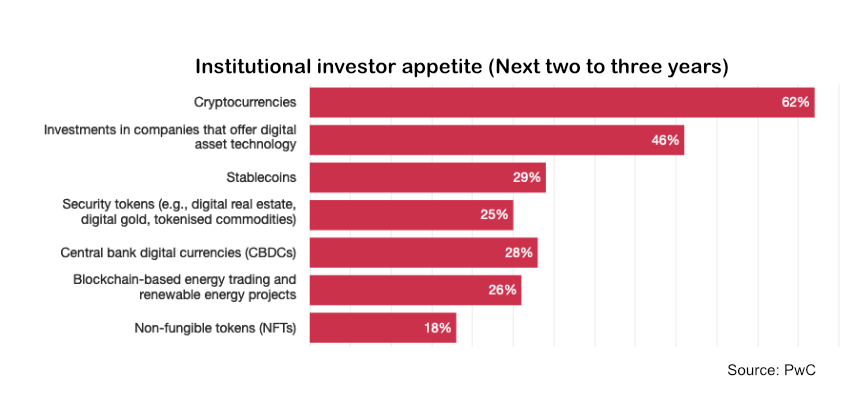

Demand for Digital Assets: A Timeframe Discrepancy

PwC’s survey also posed questions with differing timeframes, complicating the comparison between asset and wealth managers and investors. Asset managers were asked to identify which digital assets have seen the highest demand over the past year, while investors were queried about their interests over the next two to three years.

Crypto Leads the Way

Regarding preferences for digital assets, asset managers indicated a strong interest in cryptocurrencies, with 57% favoring this area, closely followed by investments in digital asset companies at 54%, and security tokens at 41%. Looking ahead, investors expressed an even greater desire for cryptocurrencies, with 62% showing interest compared to other digital asset types. Investments in digital asset companies ranked second among investor preferences at 46%, while security tokens fell to sixth place at 25%.

Analyzing the Survey’s Credibility

As with many surveys, the interpretation can hinge on who is classified as an institutional investor. If a significant number of participants are crypto specialists, it could skew the findings. PwC reported that 264 asset managers and 257 investors participated in the survey, with over half managing assets exceeding $10 billion.