Market Movements in Premarket Trading

Investors are keeping a close watch on companies that are making news in premarket trading today. Here’s a wrap-up of the latest market highlights:

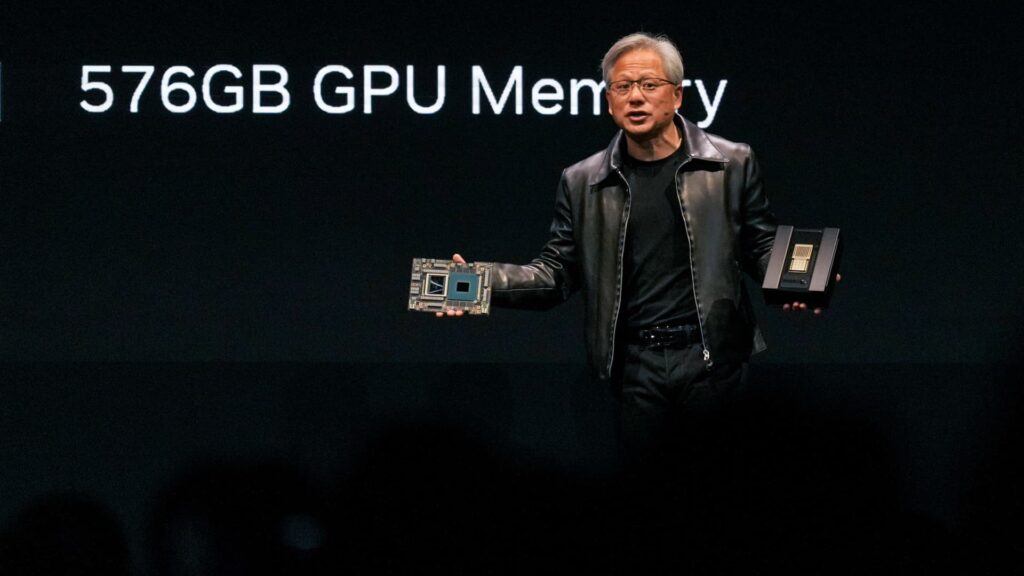

Nvidia Soars Back

Nvidia, a leader in artificial intelligence technology, has shown resilience, bouncing back by approximately 3% after experiencing a sharp decline of 17% the previous day. Other companies deeply integrated in the AI sector, such as Broadcom and Oracle, also saw their stocks rise by over 2%.

Boeing’s Disappointing Quarter

In contrast, Boeing’s stock dipped slightly by nearly 1% after the company reported fourth-quarter results that missed expectations. Boeing announced an adjusted loss of $5.90 per share, while analysts had anticipated a loss of $3.00. Additionally, the company’s fourth-quarter revenue of $15.24 billion fell short of analyst projections of $16.21 billion.

Autodesk Gains Ground

On a positive note, shares of Autodesk climbed more than 2% following an upgrade from neutral to outperform by Mizuho Securities. Analyst Siti Panigrahi highlighted signs of potential recovery in the industrial data sector, which may point to encouraging developments ahead.

Kimberly-Clark’s Small Slide

Kimberly-Clark experienced a slight dip of 1% after its fourth-quarter earnings slightly undershot expectations. The company reported adjusted earnings of $1.50 per share, slightly below the Wall Street projection of $1.51. Although net sales declined year over year due to a corporate transformation, organic sales did see a rise of 2.3%.

General Motors’ Mixed Performance

General Motors saw its stock marginally lower despite surpassing expectations for its fourth-quarter results and future guidance. The company reported earnings of $1.92 per share, excluding certain items, on revenues of $47.70 billion, compared to analyst forecasts of $1.89 per share and $43.93 billion in sales. GM anticipates full-year earnings to be between $11 and $12 per share, slightly exceeding the FactSet median estimate of $10.86.

Royal Caribbean Cruises Shines Bright

Royal Caribbean Cruises enjoyed a nearly 6% stock gain after reporting an impressive earnings performance for the fourth quarter. The company also offered an optimistic earnings forecast for the first quarter and full year, projecting earnings per share between $2.43 and $2.53, surpassing analyst expectations of $2.35.

Synchrony Financial Faces Fallout

Conversely, Synchrony Financial’s shares slipped 5% after its fourth-quarter earnings fell short of forecasts. The company reported earnings of $1.91 per share, below the anticipated $1.93.

JetBlue’s Modest Decline

JetBlue’s stock dipped more than 7% despite beating earnings expectations for the fourth quarter. The company reported a smaller-than-expected adjusted loss of 21 cents per share, against analyst forecasts of a 31-cent loss. JetBlue’s revenue for the quarter stood at $2.28 billion, exceeding the expected $2.25 billion. The airline expects capital expenditures for the full year to be around $1.4 billion, higher than the $1.25 billion forecast from analysts.

RTX Sees Positive Momentum

RTX, the defense contractor, witnessed a 4% surge in its shares driven by impressive fourth-quarter results that topped analyst expectations. The company reported earnings of $1.54 per share on revenue of $21.62 billion, surpassing analyst predictions of $1.38 per share and $20.54 billion in revenue.

Lockheed Martin’s Revenue Woes

Finally, Lockheed Martin’s stock fell over 3% following disappointing revenue figures for the fourth quarter. The company’s revenue of $18.62 billion came in under the expected $18.91 billion by analysts, painting a less favorable picture for investors.