Political Crisis Continues to Impact French Assets

A significant discount remains a challenge for French assets, as Prime Minister Francois Bayrou’s efforts to navigate the ongoing political turmoil have not been sufficient to draw investors back. For that to happen, a clear strategy to address the country’s substantial budget deficit is essential.

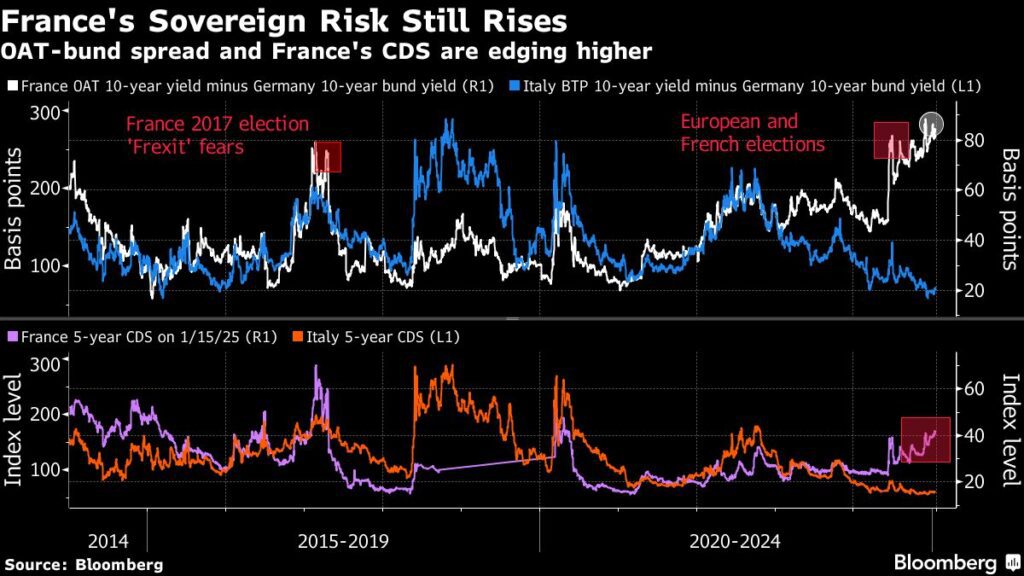

French financial markets have been on shaky ground since President Emmanuel Macron announced snap elections over six months ago. The CAC 40 index has lagged behind many other major European indices this year, while the costs associated with insuring debt against default have risen. Currently, the yield gap between French and German bonds has widened to approximately 80 basis points, nearly double what it was before the election, indicating investor concerns. Meanwhile, trading activity on French markets has noticeably slowed since August.

Calls for Change in Budgetary Reforms

Vincent Juvyns, global market strategist at JPMorgan Asset Management, remarked, “A sword of Damocles is hanging over French stocks.” He pointed out that the market demands decisive action regarding the budget deficit, emphasizing the urgency for the CAC 40 and Europe to resolve uncertainties and pursue necessary budgetary reforms to enhance competitiveness.

Juvyns predicts a “very likely scenario” of new elections in July and notes that the current spread of 80 basis points between French and German yields appears low, considering the existing political deadlock and budgetary issues. “Many observers believe that a spread of 100 basis points would be more appropriate given the current situation,” he added.

Investors Remain Skeptical of Deficit Plans

Bayrou’s recent announcements aim to target a 2025 budget deficit of 5.4% of GDP, slightly above the previous administration’s goals. While this has been met with a moderate positive response from the markets, skepticism lingers among investors regarding the feasibility of reducing the deficit to align with the European Union’s 3% guideline by 2029. Facing a no-confidence vote later this Thursday, Bayrou’s government may survive, but he is actively engaging with political parties to avoid the same fate as his predecessor given the prospect of more elections in the coming weeks.

Valuations Under Pressure Amid Weak Earnings Growth

The challenging months preceding have not significantly altered valuations for blue-chip stocks, which face weak earnings growth. The CAC 40 is trading close to its long-term average with a forward price-to-earnings ratio of 13.5, in line with the broader Stoxx Europe 600 index. In contrast, a basket of domestically exposed French stocks curated by Goldman Sachs is trading at under 8 times forward earnings, marking the lowest level in over two years.

High Political Risk Clouds Investment Opportunities

According to Arnaud Girod, head of economics and cross-asset strategy at Kepler Cheuvreux in Paris, “French economy-exposed stocks are undervalued, but purchasing them amidst heightened political risk is futile.” He noted that the broader French stock market is largely influenced by luxury shares, on which analysts maintain a neutral stance due to ongoing trade war implications.

French stocks in general have been treated similarly by investors. The CAC 40, which derives only 15% of its revenue domestically, has underperformed relative to yield spreads. It also faces external challenges, relying on an unpredictable global economic landscape and subdued Chinese demand. Consumer discretionary and industrial sectors represent over 50% of the index, while luxury and cosmetics companies, including LVMH, Hermes International, Kering SA, and L’Oreal SA, contribute about 20%. Nevertheless, there might still be a glimmer of hope for French luxury stocks following a positive earnings report from Swiss competitor Richemont.

Outlook Remains Uncertain

Benjamin Melman, chief investment officer at Edmond de Rothschild Asset Management, expressed concern regarding the sustained underperformance of French equities since the year’s onset, noting that risk discounts persist. However, he also acknowledged a shift in strategy from the previous government which could lend some sustainability to the current administration. “That said, visibility remains very low,” he concluded.