Investors Advised to Increase Risk Assets Allocations Amid Market Shifts

As market dynamics shift, Pacific Investment Management Co. (Pimco) suggests that the divergence between stocks and bonds opens an opportunity for investors to boost their allocations to riskier assets.

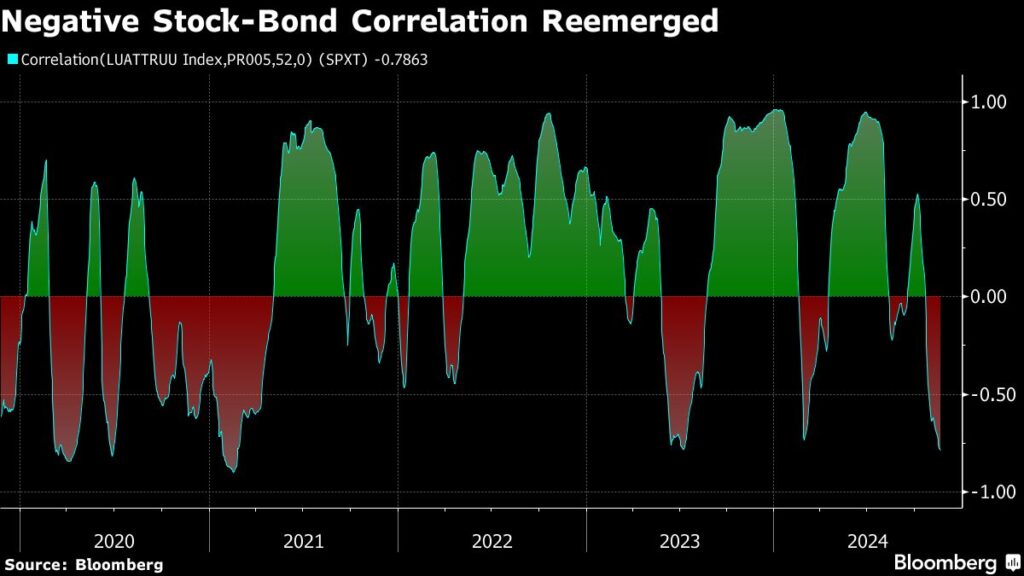

Reviving Relationships

Recent analyses indicate that as inflation pressures ease and U.S. economic growth decelerates, the correlation between equities and bonds has once again transformed. According to Pimco, a global leader in bond management, this inverse relationship is a crucial indicator for investors.

Insights from Pimco Portfolio Managers

Erin Browne and Emmanuel Sharef, prominent portfolio managers at Pimco, noted in a recent report that “the correlation between stocks and bonds often becomes lower and even negative when inflation rates and GDP growth begin to moderate, which is precisely the scenario in the U.S. and other major economies today.” They emphasized that investors have the opportunity to enhance and diversify their exposure to risk assets, potentially reaping higher returns with minimal additional volatility to their overall portfolios.

Market Performance

The market’s performance this year reflects these trends: the Bloomberg U.S. Aggregate Index has increased by 1.6% as of Tuesday, while the S&P 500 Index has soared by 24% since the beginning of 2024.

Complementary Roles of Equities and Bonds

Browne and Sharef further elaborated on the complementary roles of equities and bonds in a well-rounded investment portfolio, stating that both asset classes are likely to thrive under a baseline economic outlook characterized by a soft landing and continued interest rate cuts by central banks.

Federal Reserve Rate Changes

The Federal Reserve initiated a series of rate cuts beginning with a half-point reduction in September, followed by an additional quarter-point reduction earlier this month. Market indicators suggest a near even chance of further rate cuts in December as policymakers strive to balance slowing growth without pushing the economy into a recession.

Historical Insights on Rate Cuts

Historically, analysis of the Federal Reserve’s rate-cutting cycles dating back to 1960 reveals that U.S. equities tend to perform well during the initial rate cuts but often see a decline approximately three months afterward. In contrast, bond returns typically remain positive whenever the Fed is in an easing phase.

Tactical Allocation Recommendations

For its multi-asset portfolios, the Newport Beach-based firm leans toward a slight overweight in U.S. equities while favoring high-quality core bonds, which usually comprise investment-grade debt.

Focus on Domestic Companies

Pimco advises investors to concentrate on U.S. companies that are less reliant on imports, particularly in light of proposed tariffs under the Trump administration. With threats of heightened tariffs on goods from China and other countries, the firm recommends looking at companies that stand to benefit from the anticipated tax cuts and deregulation initiatives.

Navigating Potential Economic Shifts

Investors are encouraged to explore allocations to inflation-linked bonds or real assets as a means to hedge against possible inflationary pressures stemming from fiscal policies and tariffs. As of Wednesday, the benchmark 10-year Treasury yield reached approximately 4.4%, a substantial increase from its recent low of 3.6% in mid-September. Furthermore, real rates, as indicated by U.S. 10-year inflation-protected securities (TIPS), have risen to slightly over 2% from around 1.5% earlier in October.

Conclusion

A lower or negative correlation between stocks and bonds provides investors with an opportunity for more diversified cross-asset positioning, especially beneficial for those with access to leverage. As financial landscapes continue to evolve, staying informed and adjusting strategies will be key for optimizing portfolio performance.