Sponsored Content

Turbulent Times for US Blue-Chip Stocks

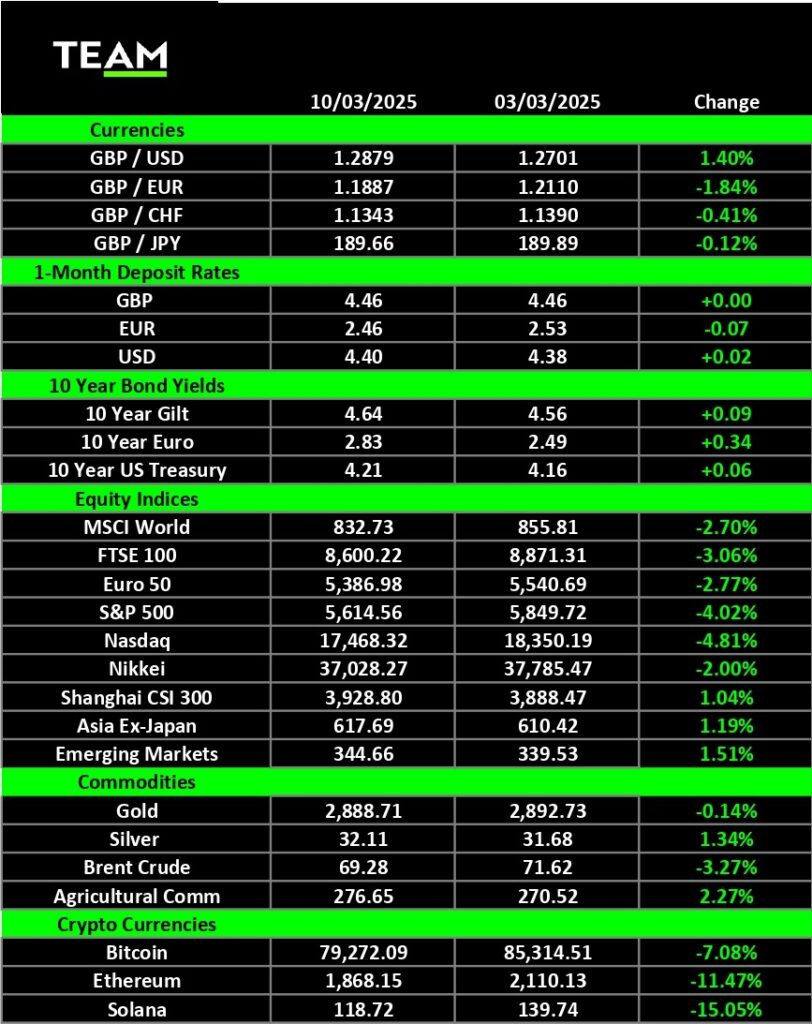

US blue-chip stocks recently experienced their most challenging week since September, raising alarms about the immediate effects of the White House’s policies on the economy. The volatility has particularly affected the so-called “Magnificent Seven” technology stocks, with Tesla at the forefront of losses, plummeting 22%. Since hitting an all-time high in mid-December, Tesla’s share price has more than halved, resulting in a staggering $825 billion reduction in market value.

Shifting Market Sentiment

The initial excitement following the US election, fueled by expectations of a pro-business agenda including tax cuts and reduced regulations, has faded. Subsequently, both the S&P 500 (-6.2%) and tech-centric Nasdaq (-10.9%) indices have shown declines since the presidential inauguration on January 20.

Trade Wars Trigger Market Stress

Initial selling pressures were set off by President Trump’s announcement on Monday night of 25% tariffs on imports from Canada and Mexico. Although these measures were paused for a month, heightened tensions in trade with China remain, with tariffs doubled to 20% and China retaliating by imposing its own tariffs on select US goods, including agricultural products like soybeans, pork, beef, and seafood.

Economic Implications and Job Market Concerns

As uncertainty looms, the economy is showing signs of distress. Recent data revealed that only 151,000 jobs were added in January, with the unemployment rate edging up to 4.1%. The Atlanta Federal Reserve’s GDPNow Model predicts a contraction of 2.4% for the first quarter, although this forecast diverges from more optimistic economic predictions. In a recent interview, the president acknowledged the potential for recession or increasing inflation this year, emphasizing that a significant transition is underway.

Global Response to Economic Shifts

In a contrasting response, European stock losses have been less severe, attributed mainly to Germany’s unprecedented shift in economic policy. With growing concerns that the EU can no longer rely on US security guarantees, the German government announced a €1 trillion spending initiative to modernize its military and infrastructure, prompting the largest single-day sell-off in German government bonds since March 1990.

Volatility in Cryptocurrency and Commodities

The broader risk-averse environment has similarly impacted cryptocurrencies, with Bitcoin dropping an additional 7%, falling back below $80,000 for the first time since November. Investors expressed disappointment following the White House’s announcement of a strategic reserve for cryptocurrency, centering on the use of tokens acquired through investigations.

In the commodities market, Brent crude oil faced downward pressure, sliding to $69 per barrel—its lowest in six months. With OPEC+ expected to resume production cuts in April, adding a supply of about 138 million barrels per day, traders are worried about a potential market imbalance amidst these economic headwinds.

Upcoming Economic Indicators

The economic calendar for the upcoming week prominently features the US inflation report for February. Analysts forecast a slight dip in annual CPI from 3% to 2.9%, marking the first instance of inflation falling below the crucial 3% mark.