Market Movements Before the Bell: Key Players in Focus

As the market opens, several companies are making headlines due to significant stock movements influenced by earnings reports and operational announcements.

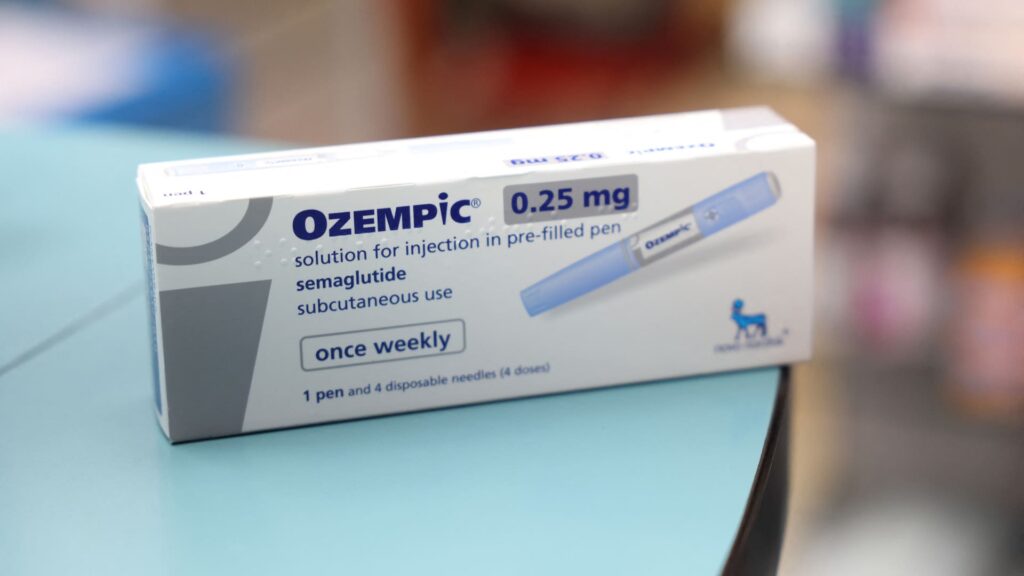

Novo Nordisk Faces Setback

Novo Nordisk’s shares took a substantial hit, plummeting over 19% after the Danish pharmaceutical titan released discouraging late-stage trial results for its new weight loss drug, CagriSema. In contrast, competitor Eli Lilly saw its stock rise by more than 6% thanks to this development.

FedEx Reports Strong Earnings

FedEx’s stock surged 8.5% following the announcement of a spinoff of its freight business. The logistics giant reported earnings per share of $4.05 for its fiscal second quarter, significantly exceeding the $3.90 expected by analysts. However, its revenue of $21.97 billion fell short of the anticipated $22.10 billion.

Nike’s Struggles Continue

Nike’s stock price dropped over 7% despite beating the already tempered expectations from Wall Street. The athletic apparel retailer reported year-over-year declines in both revenue and earnings, with the CEO indicating that the company’s turnaround plan may take longer than anticipated.

Mission Produce Shines

Mission Produce experienced a remarkable rise, with shares increasing more than 10% thanks to better-than-expected results for its fiscal fourth quarter. The avocado producer’s strong performance stands in stark contrast to several of its industry counterparts.

U.S. Steel Issues Cautious Outlook

U.S. Steel’s stock fell 6% after the company provided a disappointing forecast for its fourth quarter. U.S. Steel now anticipates losses ranging from 25 to 29 cents per share, while analysts had previously expected a profit of 22 cents per share.

Tesla’s Decline Continues

Tesla’s stock experienced a near 5% decrease, compounding nearly a 1% loss from the previous session. The electric vehicle manufacturer is feeling the pressure from a wider market sell-off as investors capitalize on gains from recent high-performing stocks.

Berkshire Hathaway’s Influence on Occidental Petroleum

Occidental Petroleum’s shares rose approximately 2% following news that Warren Buffett’s Berkshire Hathaway acquired shares in the energy firm. Stocks of Sirius XM and VeriSign also saw movement, with Sirius XM gaining over 1% and VeriSign dipping slightly by 0.2%.

Micron Technology Faces Further Losses

Micron Technology’s stock fell by 2.9%, adding to losses after posting the worst performance since March 2020, attributed to disappointing second-quarter guidance.

Trump Media and Its Fallout

Trump Media’s stock declined more than 5% after President-elect Donald Trump transferred his entire stake in the company to a revocable trust. This decline was compounded by a failed House Republican spending deal supported by Trump, which aimed to prevent a government shutdown.

Starbucks Baristas Plan Strikes

Starbucks experienced a stock slump of about 1% as baristas in major cities like Los Angeles, Chicago, and Seattle prepared for strikes demanding better wages and scheduling. The Workers Union, representing baristas at 525 Starbucks locations, hinted that nationwide walkouts could escalate by Christmas Eve.

Crypto-Linked Stocks Struggle

In the realm of cryptocurrency, stocks linked to the sector, including MicroStrategy and Coinbase, saw declines of around 5.5% as Bitcoin prices continued to drop. Shares of Robinhood also fell by 6%. This downturn follows the Federal Reserve’s cautious stance regarding fewer interest rate cuts next year, creating ripples throughout equity and crypto markets.

The fluctuations in these stocks reflect the dynamic and often volatile nature of the market, where good news in one sector can spell trouble for another. Keep an eye on how these developments unfold as the trading day progresses.