Midday Market Movements: Notable Stocks Making Headlines

Several companies are generating significant buzz in midday trading today, showcasing a variety of performances across the market.

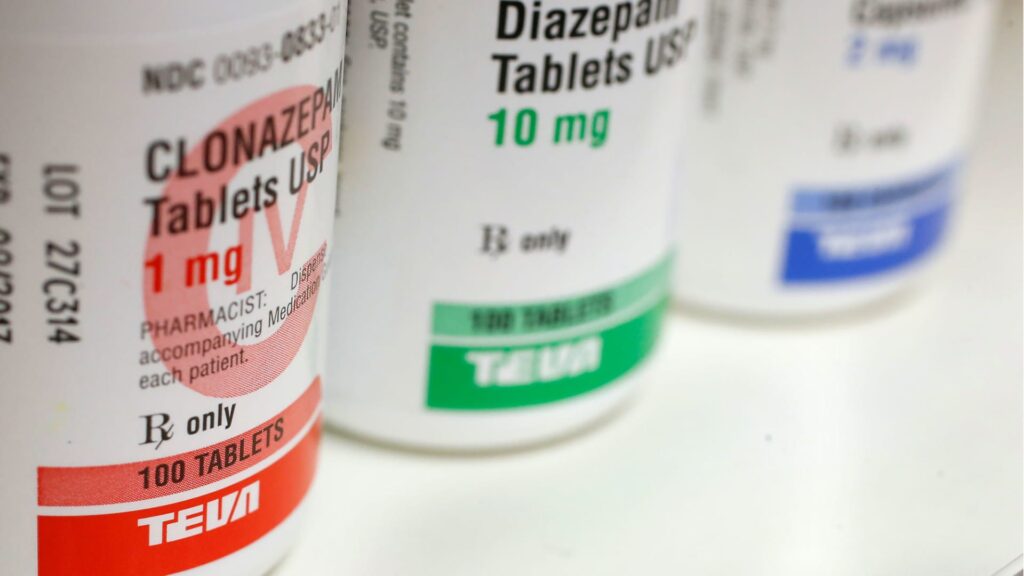

Teva Pharmaceuticals and Sanofi Surge

Shares of Teva Pharmaceuticals and Sanofi saw impressive gains of over 26% and 6%, respectively. This uptick came after the companies shared encouraging Phase 2b results for their collaborative treatment targeting moderate to severe inflammatory bowel disease.

Pfizer’s Positive Outlook

Pfizer’s stock climbed more than 4% after the biopharmaceutical giant revealed a 2025 revenue forecast in line with Wall Street expectations. Anticipating revenues between $61 billion and $64 billion, Pfizer’s prediction aligns closely with the consensus estimate of $63.22 billion, as per FactSet.

Quantum Computing Breakthrough

In a remarkable turn of events, Quantum Computing’s stock surged over 51%, hitting a new 52-week high. This leap followed the awarding of a significant contract by NASA’s Goddard Space Flight Center, which seeks to utilize Quantum’s Dirac-3 entropy optimization machine for advanced imaging and data processing.

SolarEdge Technologies on the Rise

Following a double upgrade from Goldman Sachs, SolarEdge Technologies experienced a more than 16% increase in its stock price. Goldman Sachs highlighted that 2025 will be pivotal for the clean energy company as it embarks on a significant turnaround.

Red Cat Faces Challenges

Drone tech company Red Cat saw its shares tumble over 7% after reporting a fiscal second-quarter loss of 18 cents per share, worse than the loss of 11 cents per share from the same period last year. However, Red Cat’s stock has risen approximately 17% over the past week, buoyed by excited speculations about recent mysterious drone sightings in New Jersey.

Nvidia and Broadcom Experience Declines

Shares of Nvidia and Broadcom faced setbacks, dropping over 1% and nearly 4%, respectively. Nvidia entered correction territory after recent declines, while Broadcom reported better-than-expected fourth-quarter earnings, boosting its market capitalization past $1 trillion—a remarkable growth of more than 39% over the past week.

Tesla Receives Upgrade

Tesla’s stock jumped more than 3% following an upgrade by Mizuho from neutral to outperform. The firm anticipates that Tesla will benefit from expected regulatory changes under President-elect Donald Trump, particularly with regards to autonomous driving.

Manchester United Grows in Valuation

Shares of Manchester United climbed around 3% after UBS initiated coverage with a buy rating. The firm believes the football club’s robust revenue base could lead to improved performance and profitability in the future.

IT Giants Show Positive Momentum

Both Epam Systems and Cognizant Technology Solutions saw their stocks rise, with increases of almost 2% and 0.4%, respectively, following upgrades to overweight by Barclays. The bank noted that these companies have made strategic investments that may position them well as demand returns in the tech sector.

Affirm Holdings and Amentum Holdings Struggle

Affirm Holdings’ shares dipped by 2.7% after announcing a private offering of $750 million in convertible senior notes, along with plans to repurchase up to $300 million of its Class A common stock. Meanwhile, Amentum Holdings experienced a 9% decline in stock value after reporting a fiscal loss of 21 cents per share for the fourth quarter, a downturn from earnings of 17 cents per share the previous year.

— Contributions from CNBC’s reporting team.