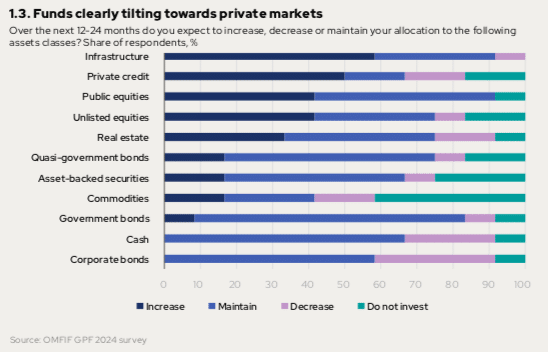

A substantial majority of global public pension and sovereign funds are increasingly favoring private markets, with four out of the five asset classes experiencing the highest demand being in this sector.

An independent forum focused on central banking, economic policy, and public investment strategies, the Official Monetary and Financial Institutions Forum (OMFIF), surveyed 28 global public pension and sovereign funds managing over $6.5 trillion in assets from September to October this year, just prior to the US elections.

OMFIF’s Global Public Funds 2024 report reveals that these funds are adopting a more risk-tolerant strategy, indicating a transition from fixed income to public equities. However, a more profound change is evident: there is a noticeable shift from liquid public markets to illiquid private markets.

Source: OMFIF

Sectors demonstrating an increased allocation by funds over the next 12 to 24 months include infrastructure, private credit, unlisted equities, and real estate, with infrastructure topping the demand list for the third consecutive year.

Almost 60% of respondents expressed intentions to boost their infrastructure allocations, according to OMFIF, while over 40% aim to increase investments in private credit or private equity within the next year or two.

Source: OMFIF

One notable instance is Calpers, the California Public Employees’ Retirement System, which decided in March to raise its private market allocations from 33% to 40% of its total plan assets.

Additionally, in September, BlackRock, GIP, Microsoft, and MGX—a technology investing firm linked to the UAE’s Mubadala—launched the Global AI Infrastructure Investment Partnership, aiming to invest $100 billion in new and enhanced data centers and energy infrastructure, primarily within the United States. This initiative seeks to attract $30 billion from private equity investors to unlock a total investment potential of $100 billion, including debt financing.

Winston Ma, an adjunct professor at NYU School of Law and former managing director of North America at the China Investment Corporation, noted: “Digital infrastructure has emerged as a pioneering asset class, serving as an innovative means for technological investment, while also supporting developmental goals within various nations.”

Mark Wiedman, BlackRock

Mark Wiedman, head of BlackRock’s global client business, mentioned in the firm’s 2025 Private Markets Outlook that the private market sector is currently valued at $13 trillion and is projected to surpass $20 trillion by the end of the decade, fueled by substantial allocation increases across pension, insurance, wealth, and sovereign investors.

Wiedman emphasized: “Credit and infrastructure will spearhead the swiftest growth, with a consistent demand for transparent, comprehensive information on private investments in relation to overarching portfolios.”

Accessing Private Markets for Retail Investors

According to Christopher Davis, head of US fund research at ISS Market Intelligence, asset managers are looking to navigate the competitive landscape by carving out niche markets, such as making private market opportunities available to retail investors.

For instance, State Street and Apollo, a private equity heavyweight, have petitioned the SEC to fuse public and private debt in an exchange-traded fund.

Christopher Davies, ISS

“In this race towards private markets, traditional asset managers will face fresh competitive dynamics, emerging not only from conventional contenders but also from alternative specialists who capitalize on their expertise and the allure of exclusivity,” Davis remarked.

He further noted that various strategies for competition could arise, including leveraging in-house capabilities, collaborating with alternative managers, or pursuing acquisitions.

For example, BlackRock has recently announced the $12 billion acquisition of HPS Investment Partners, a private credit firm.

This move follows BlackRock’s acquisition of Global Infrastructure Partners, an independent manager overseeing over $170 billion in assets, which was finalized in October this year. In 2019, BlackRock also procured eFront, a comprehensive alternative investment management software solution, allowing investors to effectively manage portfolios spanning both public and private asset classes via seamless integration with Aladdin, BlackRock’s technology platform.

Larry Fink, BlackRock

In June, BlackRock announced its £2.55 billion acquisition of Preqin, a leading provider of private markets data, a deal that is still pending closure.

Larry Fink, chairman and CEO of BlackRock, proclaimed that the firm is poised to lead the indexing of private markets, similar to how indexing has standardized public markets.