As 2024 draws to a close, South Korea has witnessed a remarkable increase in the number of digital asset investors. For the first time ever, the country has compiled extensive statistics from its five leading cryptocurrency exchanges: Upbit, Bithumb, Coinone, Korbit, and Gopax.

This pivotal development could encourage the government to establish a safer trading atmosphere, safeguard investors’ rights, and promote market stability.

Unprecedented Growth: 15.59 Million Crypto Investors in South Korea

As reported by Yonhap News Agency, Representative Lim Gwang-hyun of the Democratic Party in South Korea shared insights from the Bank of Korea. The data indicates that by late November, the number of domestic digital asset investors had reached an astounding 15.59 million, marking a rise of 610,000 since the end of October. This number represents about 30% of South Korea’s total population of approximately 51.23 million.

In November, South Korean digital asset exchanges saw an impressive average daily trading volume of 14.9 trillion KRW (approximately $10.5 billion), nearly equating the combined trading values of the KOSPI stock market and KOSDAQ, which were 9.92 trillion KRW and 6.97 trillion KRW, respectively.

By the close of November, the cumulative value of digital assets held by investors in South Korea soared to 102.6 trillion KRW (about $70.3 billion), a significant rise from 58 trillion KRW ($39.7 billion) in October.

Furthermore, deposits, or funds that are yet to be invested and remain on exchanges, surged to 8.8 trillion KRW ($6.03 billion) by the end of November, a substantial increase from 4.7 trillion KRW ($3.2 billion) at the end of October.

“The scale of digital asset trading is experiencing rapid growth and now rivals that of the stock market. The government must be fully prepared to create a safe trading environment, protect users’ rights, and ensure market stability,” emphasized Representative Lim Gwang-hyun.

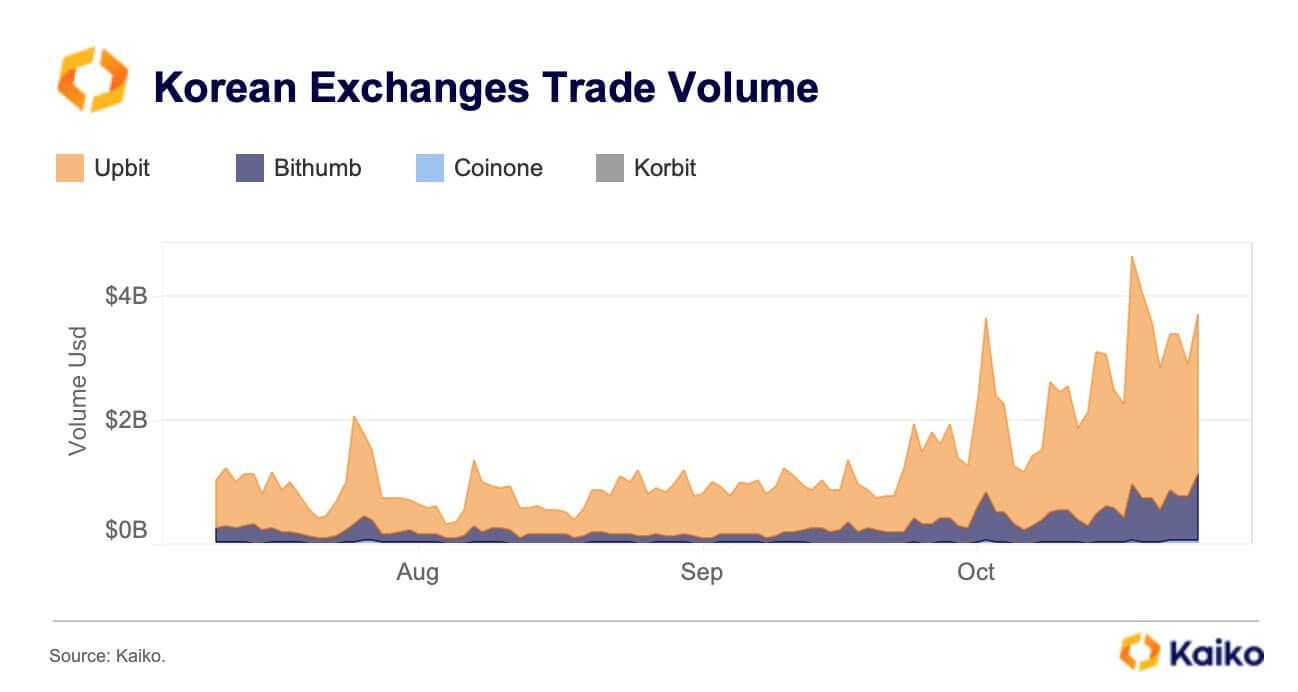

Additionally, analysis from Kaiko shows that in November, trading volumes in South Korea’s cryptocurrency exchanges surged, with a significant concentration of activity on Upbit. Between September 2020 and May 2021, Upbit’s market share increased from 43% to nearly 90%, and it has maintained these high levels ever since, with altcoins comprising 88% of the trading activity on the platform.

Despite these advancements, the crypto market in South Korea is grappling with challenges, particularly following President Yoon Suk Yeol’s unexpected announcement of martial law. Although martial law was later lifted, the crypto trading landscape still faces various regulatory obstacles.

Disclaimer

In alignment with the Trust Project guidelines, BeInCrypto is dedicated to delivering unbiased and transparent news. This article aims to present accurate and timely information. However, readers should independently verify all facts and consult professionals before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been recently updated.